Gold’s lasting worth can be attributed to several factors, such as its perception as a symbol of grandeur, power, and prosperity. Throughout history, gold has held a revered and highly sought-after status as a substance. For millennia, people have used gold as currency and as ornaments.

Facts about gold and the properties of gold:

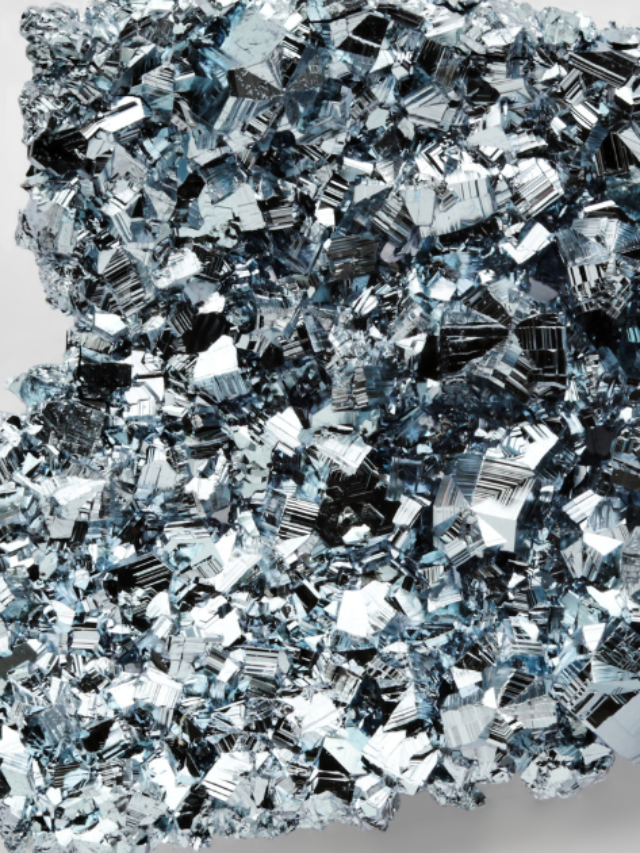

Throughout the world, gold—represented by the chemical symbol Au—can be found in alluvial deposits and mineral veins. It is frequently produced as a byproduct of other metals, such as copper and lead, however there are also sizable mines that only produce gold. A single one-ounce nugget is more difficult to locate than a five-carat diamond.

History Of Gold:

Since it was first mined in Lydia in 550 BC, during the reign of King Croesus, gold has occupied a special place in human history and been a valuable commodity. Gold has long been connected by historical civilizations with attributes like enlightenment and immortality. Today’s society continues to view gold as a symbol of perfection, as evidenced by activities like following the “golden rule” and competing for gold medals. It has been given to gods, turned into legendary golden towns such as El Dorado, and sparked actual gold rushes in places all over the world, from South Africa to Canada.

Why is gold valuable?

Over thousands of years, humanity has progressively come to understand the worth of gold. Gold’s role in creating the world’s first coinage gave it a lasting significance, and until about 50 years ago, the metal remained the foundation of the global currency markets.

Precious metals were the ideal material for the initial payment systems because they allowed dealers and merchants to exchange actual units. This meant that products could be exchanged in theory without the requirement for prompt delivery and served as a mutually accepted unit of exchange that was immediately comparable with one another.

Why is gold more valuable than silver and copper?

While platinum has its own robust qualities and is equally difficult to locate as silver, copper is easier to find and a superior electrical conductor. Silver, on the other hand, has far more industrial applications than gold. Why, therefore, does gold command a higher price than these other metals?

Surprisingly, the reason why gold has a higher value than other metals is because it is so chemically boring and difficult to work with. Unlike gold, all three will eventually tarnish to some extent. It is because of these unchanging qualities that make gold so much more valuable than other metals. Unlike other commodities, they also alter the dynamics of supply and demand in the gold market. All of the gold that has ever been produced still exists, in contrast to metals like copper that are produced and subsequently consumed.

How much gold is there in the world?

Just over 190,000 tonnes of gold have ever been mined, according to the World Gold Council, an international trade organization that counts some of the biggest miners as members, including Agnico Eagle, AngloGold Ashanti, Barrick Gold, Newcrest Mining, and Newmont Mining. That works out to more than 6 billion ounces, which, while impressive, still amounts to less than one ounce of gold for each person on the planet. Remarkably, mining has produced more than two thirds of this gold since 1950.

Every year, between 2500 and 3000 tonnes more gold are produced globally than are already in stock. Although the metal is found all over the world and in a variety of geographical locations, the top ten nations create over two-thirds of the new gold produced annually.

Uses of gold: what is gold used for?

There are four main markets for gold: central banks keep it, investors exchange it, and merchants utilize it to make jewelry or as a component of digital applications.

Approximately 50% of all gold is used to make jewelry. The current gold jewelry industry is concentrated in the East, with China and India meeting up to half of global demand.During the same time period, 27% of the demand for gold came from investment markets. This is the lowest percentage of total demand since 2015, and it is far less than what was observed between 2008 and 2012, when up to 40% of all demand for gold came from trading, the height of the financial crisis. When the financial markets started to rebound in 2013, the percentage dropped to barely 18%. It subsequently increased to reach its highest point of 37% in 2016 and then dropped to 30% in 2017.

The Cost of Gold:

Gold’s enduring allure, combined with its use in various industries, pushed the price of an ounce of gold past $2,110 in December 2023. This was an all-time high against the greenback. The relative rarity of gold is a key pricing factor, but more factors contribute to its unwavering value than supply and demand. Silver has an annual production of about 1 billion ounces compared with about 150 million ounces of gold. That doesn’t mean that gold costs eight times as much as silver as the supply differential would suggest. In fact, gold trades between 75 to 90 times the price of silver.

Pingback: Top 10 Most Expensive Metals In the World

Pingback: Periodic Table | Astrobites